Central banks around the world have been raising interest rates to make borrowing more expensive and cool the hottest inflation in decades. The United States economy is stuck in a stagflation state. Interest rates continues to rise while the cost of goods and services also increase. 13 trillion Us Dollars we’re printed in 2021. The average 30-year fixed mortgage rate jumped to 7.08% in September 2022. S&P 500 and NASDQ recorded three consecutive quarterly declines for the first time since the 2008 recession. German inflation to hit 10% in September, preliminary reading shows which is the highest increase since WWII.

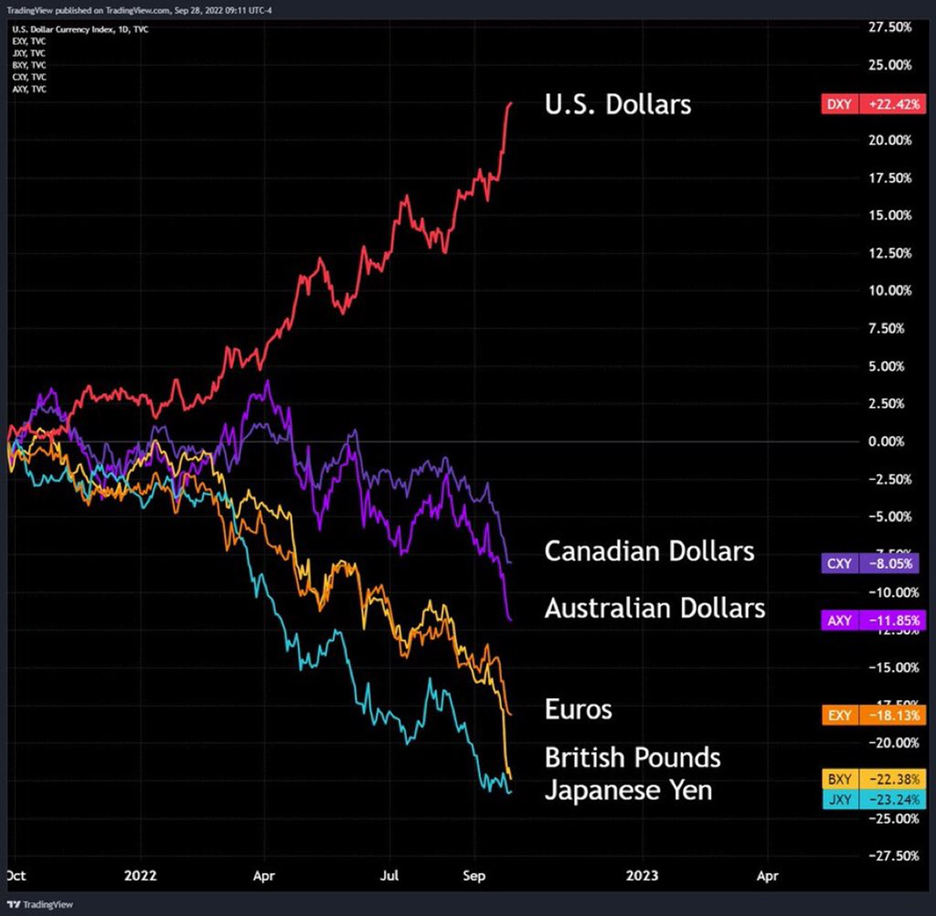

China’s economy is heavily linked with its real estate economy, this economy has suffered since Covid-19. High energy and commodity prices are weighing on demand and putting pressure on profit margins. The European economy has recovered since the beginning of Covid-19. Energy cost will continue to hurt the European economy along with raising interest rates. The pound has hit a record low against the dollar after the UK government announced sweeping tax cuts in a mini-budget last Friday. in the last few weeks, the euro has fallen below the value of $1.00. The interest-rate gap between Japan and the United States continues to widen.

Both Credit Suisse and Deutsche are the biggest banks in Switzerland and Germany respectively and have a history of more than 150 years. These banks are indeed ‘ too big too fail’, but there financial health is an another indications that major European banks are struggling to remain solvent.

Russians economy continues to be cut of my big sectors of the world. World economies and currencies are intertwined and the value of these currencies will continue to falter. A lot of economists are predicting the rise of Central Bank Digital Currencies (CBDC). These currencies will follow the same suit as the current dollar, pound, yen if they are controlled by the same organizations.

Russian President Putin has officially announced and signed the Annexation of the Ukrainian Regions of Donetsk, Luhansk, Kherson and Zaporizhzhia into the Russian Federation, he also stated that these Annexed Regions will be defended using all weapons in the Russian Arsenal. This will further the pain the world currencies are currently enduring. This is just the beginning to the war in Ukraine and the full effects of the world will have a resounded effect on the world economies.

In the next ten years humanity may gain a recognition for currencies that have a limited supply, an ease to transaction funds and a secure blockchain. This is a reason many people continue to believe in Bitcoin. Bitcoin solves a lot of problems that are currently occurring with other currencies today. If people or governments have the power to print more money, then the value of that currency will one day lose value. Monetary fiscal policy can’t fix the currency economic problems we face in 2022.

Due to the popularity of Doge coin, the security of Shiba Swap and the scarcity of Bitcoin, I am inclined to be bullish on $Leash. Not to mention the uncertain that all the fiat currencies are currently providing will only continue. Leash is connected to Shiba Inu’s ecosystem which will continue to gain trust over the regular financial business moving forward into the next decade. It is possible that in the future people will view Leash like how people view Silver or Gold today.