Cross Chain Farming

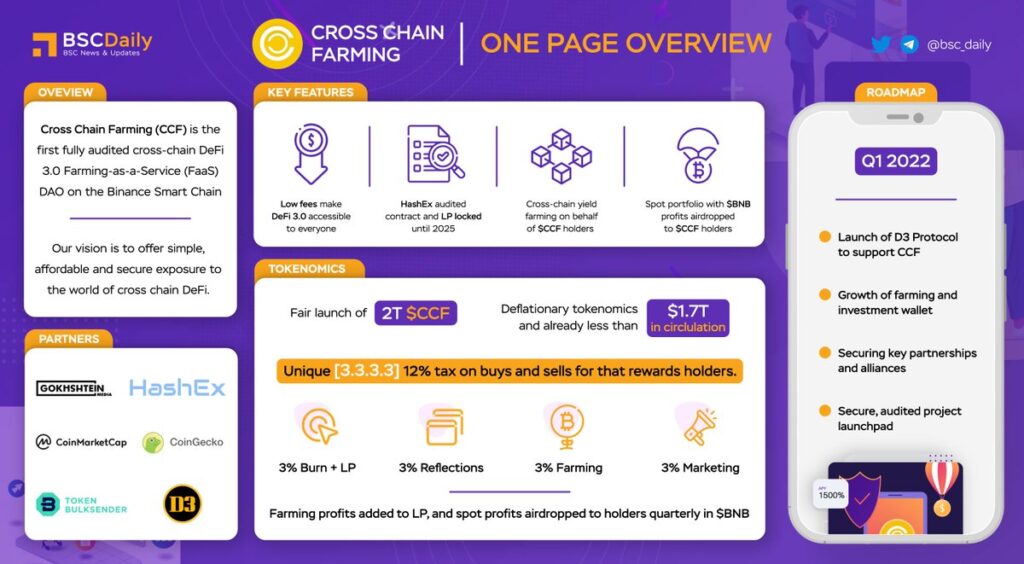

Cross Chain Farming (CCF) is a hard fork of MCC. CCF introduces a new concept called Farming-as a-Service (FaaS) to the DeFi world. CCF can be described as an index fund. DeFi yield farming is an action used to multiple cryptocurrency assets. It involves locking or lending your assets via smart contracts for activities such as:

Staking tokens to help with the governance of a decentralized ecosystem

Providing liquidity to trading pairs on decentralized exchanges.

What is Farming-as-a-Service (FaaS)?

Farming-as-a-Service, or FaaS, is an emerging and innovative concept within the DeFi space and protocols, such as CCF, do the hard work for you! Users can buy and hold the $CCF token in your wallet, paying a tax on buys and sells. A proportion of this tax on both buys and sells goes to the CCF farming wallet. CCF uses these funds to farm for you across multiple chains (Ethereum, Avalanche, Fantom, Polygon etc.) Farming profits are then compounded and intermittently distributed to $CCF holders in $BNB once certain milestones are hit. The first payout will take place in February 2022.

Tokenomics

There is an automatic12% tax on all buys and sells of the $CCF token:

3% goes to token burns and liquidity provision (on a 2:1 ratio)

3% is redistributed to $CCF holders as $CCF reflections

3% goes to the farming wallet

3% goes to the marketing wallet.

Total Supply 1,955,773,849,789

Current Price $0.00000561197

Market Cap $10,453,113

Based on the tokenomics above this token is very deflationary. There is a CCF burn wallet that burns a percentage of all sales and buys, this action lowers the supply of the coin continuously. CCF will work for hand in hand with $DEFI. D3 Protocol ($DEFI) is a decentralized reserve currency for DeFi 3.0. CCF is a passive investment instrument. CCF holders that want to diversify their portfolios and increase their risk will be able to mint $DEFI at a discount using a portion of their $CFF tokens. DEFI has the capabilities of plugging into CCF and MCC which would build a diversified D3 protocol treasury. DEFI gives its holders staking incentives and ensures long-term sustainability. This means with CCF tokens holders will receive BNB which they can use to buy more CCF. CCF holders can also use their CCF to mint $DEFI.$DEFI can be compared to the cryptocurrency $TIME or $Olympus (OHM). $DEFI is a very special DeFi 3.0 token that may prove to be a very successful financial tool. CCF can be bought here at Poocoin.