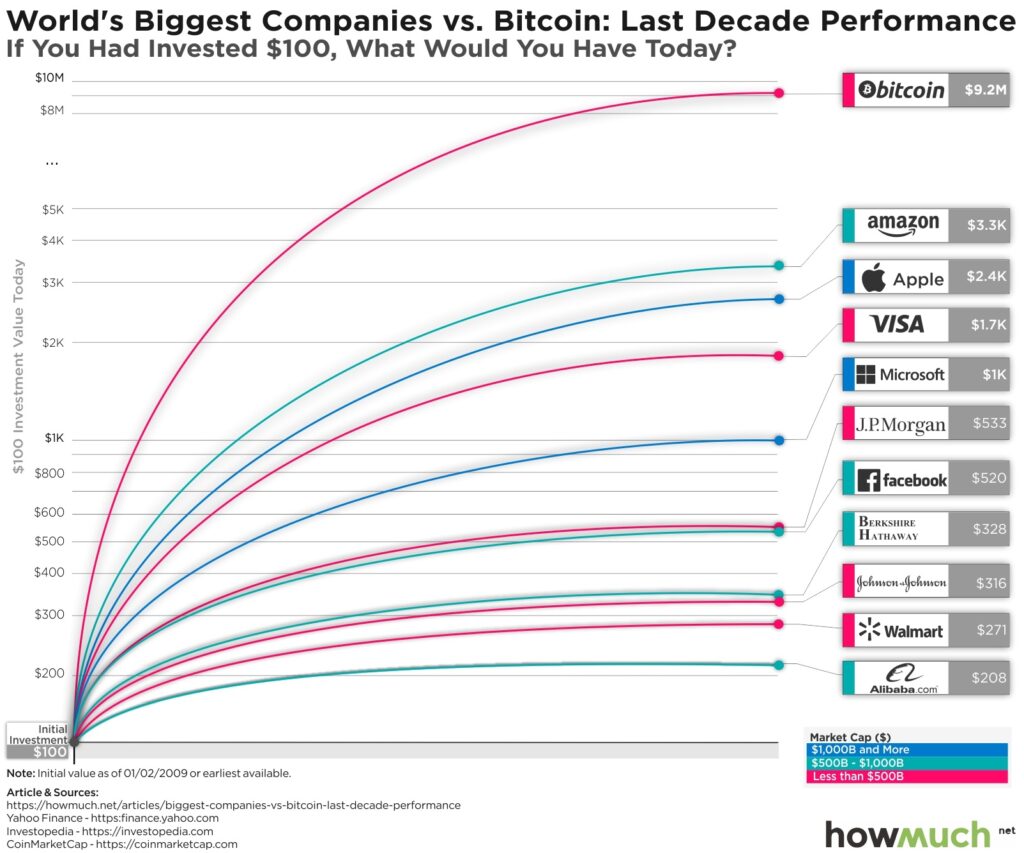

I’ve been blessed with the flexibility of traveling across the United States since COVID-19 began. Most of the time when I talk to people in different cities, I bring up the world of cryptocurrency. Usually, the response I get from people is, “Oh yeah Bitcoin is cool but I missed the opportunity”. Ten years ago an investment in BTC would have cost $31.91. The price of one Bitcoin today is $44,152.79. In ten years, an investment in 1 BTC would have returned you 138,266.62% The cryptocurrency world is an infant and the time to invest is now.

(Published 12/09/2019)

The United States dollar will not continue to be the world currency. Several countries across the world export to the USA and receive dollars as the form of payment. Countries keep this currency in foreign reserves in case their businesses need it for international trade. For example, China and Japan use the US dollar to buy US treasuries causing the value of the dollar to be higher relative to their own currencies. This gives their native currency a competitive advantage because their exports become cheaper. This has been going on for decades, but what happens when countries stop holding the US dollar in currency reserves? Russia has already sold several millions of its dollars in exchange for other currencies. It doesn’t matter who the President of the United States is the United States government has always used the dollar through sanctions to control and squeeze other countries. In the future Russia, China and Iran will create their own central digital currencies and continue to operate outside the US dollar. Other countries will follow in their footsteps. It isn’t a surprise that the country of El Salvador is investing in Bitcoin, but that’s for another article. Around 40% of US dollars in existence were printed within the last 18 months. The United States government is printing as insane amount of money! Flooding the economy with this amount of new money in such a short little time will lead to massive repercussions for the dollar.

It is possible the retirement age is increasing due to the value of the dollar decreasing. Remember the world still hasn’t experienced the full financial effects of Covid-19 and inflation doesn’t seem to be going away anytime soon. Therefore, the value of the dollar will rather continue to decrease before it increases if it ever does. The government is now printing money to pay off its debts and there is nothing stopping the government from continuing to print money to cover social security benefits for example. Social security was supposed to be an aid to help people in retirement or disability. In the coming decades there will not be enough people working to pay of future social security benefits, thus causing the government to print more money and cut social security benefits.

Investing in natural resources isn’t an option I suggest because natural resources are controlled by governments and entities. I do believe that crude oil in a vacuum is a wonderful investment, but the amount of oil pumped every day is controlled thus controlling the real value of crude oil. During the Covid-19 pandemic OPEC lowered production by 10% and has yet to increase production by 10% thus overall affecting the price of crude oil. Essentially when investing in oil you’re investing in a system that is already being manipulated for several different reasons amongst the biggest countries and companies in the world.

For the middle class investing in real estate is a time and cost consuming action with low returns. Not to mention local laws can easily change the value of a property. If your investment is in rental property, states can enact eviction moratoriums, thus not allowing you to evict tenants who are late on payments. There are other ways to invest money without taking on the risks of buying real estate and receiving a similar return.

The days of investing in stocks and bonds are over. There are far greater and faster returns in the cryptocurrency world with holding, staking, liquidity, NFTs, blockchain gaming and yield farming. People can diversify their entire portfolios under the blockchain and smart contract umbrella. Bitcoin is scheduled to halve in the spring of 2024. As we get close to this time the price of Bitcoin will increase. We have only scratched the surface of the full potential of Bitcoin. It doesn’t matter what the current price of Bitcoin is people should buy it. Bitcoin is just one cryptocurrency in this new digital market. Once Ethereum 2.0 is achieved the flood gates will truly open and people will start to understand the opportunities that have become available due to smart contracts and dapps. Completion of Ethereum 2.0 will drastically affect the current outrageous gas fees and the increase the price of 1 Ethereum which is currently on sale at $3,139.51 at the time of writing.

References:

Amadeo, Kimberly. “Why the Dollar Is Worth so Much Less than It Used to Be.” The Balance, www.thebalance.com/what-is-the-value-of-a-dollar-today-3306105.

Juan Carlos Editor, et al. “The Investment of the Decade: Bitcoin vs. World’s Megacorps.” HowMuch, howmuch.net/articles/biggest-companies-vs-bitcoin-last-decade-performance.

Person, and Jeff Mason Trevor Hunnicutt. “U.S. Calls on OPEC and Its Allies to Pump More Oil.” Reuters, Thomson Reuters, 11 Aug. 2021, www.reuters.com/world/middle-east/us-call-opec-its-allies-increase-oil-production-cnbc-2021-08-11/.

This Post Has 2 Comments

Great post. Cryptocurrency is still very early in its adoption curve!

thanks

http://bkharim.com/